Why Choose ACE?

ACE is an independent technology firm founded by notable industry innovators. We connect advisors and their clients to tailored credit and cash solutions from industry leading banks and lenders.

Wealth Management Firms and Advisors

Solve with Confidence

Now Advisors can deliver cash and credit solutions through a dedicated network of providers, selected for product excellence and financing expertise. Finding the best-fit solution starts with presenting pre-screened opportunities to clients. Other benefits may

include lower risk of decline, confidence in rate competitiveness and accelerated speed-to-approval.

Lead the Competition

To compete for the most profitable client relationships, it is essential to arm advisors with a fully integrated platform that includes lending and cash management services.

Protect and Grow Relationships

We help advisors protect client relationships and deliver total balance management for their clients’ financial wellness.

Respecting Trusted Relationships

ACE is dedicated to maintaining and building on the trust advisors forge with their clients. We are mindful that every client relationship is built upon a relentless commitment to accountability, client focus, service quality, teamwork and integrity.

Banks and Lenders

Diverse Network

Access to a network of financial advisors, with planned expansion into the broader independent wealth management market.

Advisor Access

Access to Advisors of highly qualified clients who are “net savers” with significant asset coverage for their obligations.

Targeted Loans

Ability to create loan proposals targeted to lender qualification criteria.

Cost Savings

Highly qualified applicants lead to realizing significant cost savings for sales, marketing, processing, underwriting and funding.

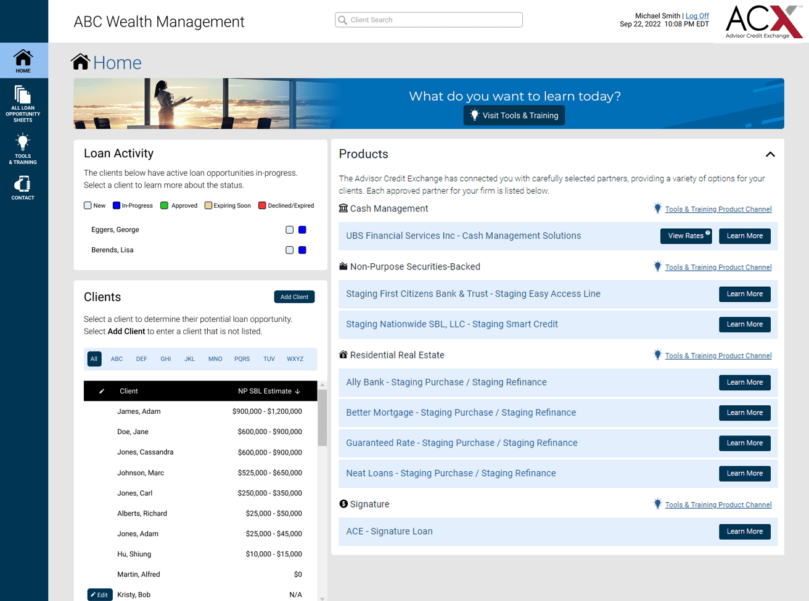

Our Platform

ACE seamlessly connects banking and lending institutions to advisors, enabling advisors to deliver non-traditional solutions as part of their clients’ financial and goals-based plans.

Products

Cash Management

Cash Management opportunities that allow your clients to easily optimize and access cash holdings by establishing a UBS RMA account and activating banking features such as Checking, Debit Cards, Core Savings and Certificates of Deposits.

Signature Loans

Loan requiring no collateral, funding within 24-48 hours and terms and rates dependent upon the size and purpose of the loan and the credit worthiness of your client.

Residential Real Estate

Residential mortgages for primary, secondary and investment properties. Terms and rates are dependent on property type, loan amount and credit worthiness of your clients.

Securities-Backed Lending

Loans collateralized by the securities in your client's portfolio. Terms and rates are dependent on the size of the loan.

What advisors are saying about ACE...

“The power of ACE enables me to address more of my client's needs and do so in an efficient and easy to understand way. It allows for deeper conversations with clients and enhanced capabilities for my practice. I recommend ACE to any advisor looking for a way to stand out!”

- Keith J. Russell

Financial Planner - Mass Mutual

“My experience with ACx has been a really good one. They have been a perfect fit for my clients and offer the extremely important benefits of liquidity, use, and control of their non-qualified assets. I encourage all my fellow financial professionals to see if their practice can be enhanced as much as mine has by adding ACx.”

-Kevin McGonagle

Redwood Financial Advisors, LLC

Some of our partners

© COPYRIGHT 2024, ADVISOR CREDIT EXCHANGE, LLC. ALL RIGHTS RESERVED